taxes on fanduel|Tax Considerations for Fantasy Sports Fans : iloilo FanDuel is legally prohibited from providing tax advice and unfortunately cannot answer this question. Instead, we highly suggest you reach out to a professional tax advisor with any . Mystery Bang (2023) Adult NC-17 10/21/2023 (US) Animation, Comedy 7m User Score. What's your Vibe? Login to use TMDB's new rating system. Welcome to Vibes, TMDB's new rating system! For more information, visit the contribution bible. Overview. In this Halloween parody special, mystery detectives Velma and Daphne encounter nightmares of .

PH0 · Understanding Fanduel Earnings Taxes: Common FAQs Answered

PH1 · Taxes with FanDuel Sportsbook

PH2 · Taxes on Sports Betting: How They Work, What’s

PH3 · Taxes

PH4 · Tax Considerations for Fantasy Sports Fans

PH5 · Sports Betting Taxes: How to Handle DraftKings, FanDuel

PH6 · How to Pay Taxes on Sports Betting Winnings

PH7 · How Much Taxes Do You Pay On Sports Betting?

PH8 · How Much Are FanDuel Winnings Taxed?

PH9 · FanDuel Taxes 2023: How to Pay Taxes on Betting Winnings

BDO Unibank is regulated by the Bangko Sentral ng Pilipinas with contact number (+632) 8708-7087and with email address [email protected], and webchat at www.bsp.gov.ph. For concerns, please approach any BDO personnel in this branch, or contact us thru our 24x7 hotline (+632) 8631-8000 or email us via .

taxes on fanduel*******FanDuel is legally prohibited from providing tax advice and unfortunately cannot answer this question. Instead, we highly suggest you reach out to a professional tax advisor with any personal income tax questions. You are solely responsible for recording, reporting, paying, and accounting for any . Tingnan ang higit paThe Player Activity Statement is a summary of your FanDuel wallet and gameplay activity. It summarizes transactional movement such as deposits, withdrawals, winnings, bets, and more. Learn more about the Player Activity Statement. Tingnan ang higit paTax Forms for a particular Tax year will be available for download on or after January 31st of the year after the calendar year in question. For example, 2023 Tax Forms will be . Tingnan ang higit paSome Tax Forms from previous calendar years are available following this link.All you need to do is click the applicable FanDuel products that you play on, select the . Tingnan ang higit paFanDuel is legally prohibited from providing tax advice and unfortunately cannot answer this question. Instead, we highly suggest you reach out to a professional tax advisor with any .

Ago 2, 2024 — If you use online sportsbooks like DraftKings, PointsBet, and FanDuel, you might need to pay taxes. Learn the taxes you’ll pay, how to file your sports betting taxes, and more.Peb 24, 2024 — Explore the complexities of tax regulation compliance for Fanduel players in this comprehensive guide. Discover the significance of documenting both cash and non-cash .Mar 21, 2022 — FanDuel Sports Betting Taxes Guide: Do I have to pay taxes on my FanDuel winnings? How Much Does FanDuel Tax? Does FanDuel take taxes out automatically?

Mar 21, 2024 — For 2023 tax returns (taxes filed in 2024), the standard deduction is $13,850 for single filers and those married filing separately, $27,700 for those married filing jointly, and $20,800 for.

Hul 1, 2024 — A federal tax hit only comes into play if your gambling winnings reach $600 or more. Also, the rate at which you’re taxed varies based on how much you win.

Abr 5, 2022 — Download App. With two weeks left before the deadline to file your federal income taxes for 2022, Action Network's Sam McQuillan sat down with Richard Gartland, who's spent more than 30 years in finance, to discuss what .OVERVIEW. Fantasy sports leagues can yield hefty winnings if Lady Luck smiles on you. If you win big—or even not so big—you'll need to save a portion of that money for the Internal .

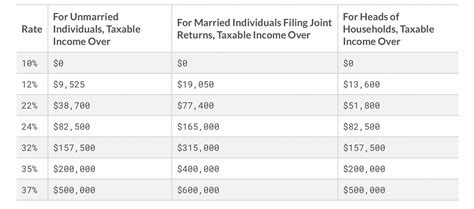

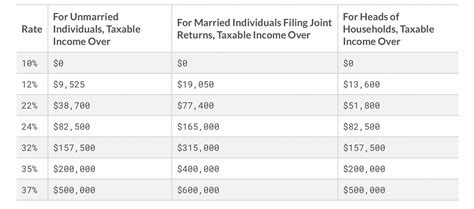

Nob 24, 2023 — 1. Income Tax. Because gambling winnings are considered taxable income, they have the same rates as other types of income.

Welcome to the FanDuel Sportsbook Tax Hub. This FAQ is intended to provide general answers to frequently asked questions related to these Tax Forms for Sportsbook. If you need help with our other products, find them on our main Tax Hub. Tax Center video overview .DraftKings, FanDuel and other betting apps are facing a bigger tax hit in Illinois following changes to tax policy this year. New Jersey, Massachusetts and other states have also tried to raise taxes on the industry or plan to. DraftKings and FanDuel count Major League Baseball and the National Football League among their biggest partnerships.taxes on fanduelDISCLAIMER - We strongly recommend that you consult with a professional tax consultant when preparing your taxes as you may need to report your winnings even if you do not receive a W-2G and no winnings were withheld. Please note, TVG does not provide tax or accounting advice. This material has been prepared for informational purposes only.Tax Considerations for Fantasy Sports Fans DISCLAIMER - We strongly recommend that you consult with a professional tax consultant when preparing your taxes as you may need to report your winnings even if you do not receive a W-2G and no winnings were withheld. Please note, TVG does not provide tax or accounting advice. This material has been prepared for informational purposes only.Welcome to the FanDuel Racing Tax Hub. This FAQ is intended to provide general answers to frequently asked questions related to these Tax Forms for Racing. If you need help with our other products, find them on our main Tax Hub. Tax Center video overview .Get answers for your Sportsbook, Casino, Daily Fantasy, TVG, Racing, or Faceoff questions

Hey everyone, So I won a $7.5k pool in FanDuel, and I was wondering if I pay taxes on that amount if I don't pull the money out of FanDuel. I think I don't because I can only send the money on more gambling on the FanDuel site unless I transfer it to my bank account.taxes on fanduel Tax Considerations for Fantasy Sports Fans FanDuel won’t send a w2g unless they absolutely have to (they don’t in this case) because they know 99% of people won’t report it and will get away with not reporting it. Making customers pay extra taxes when they barely break even or have a loss is bad for business.

May 1, 2024 — You, not FanDuel, are responsible for filing and paying applicable state and federal taxes on any winnings. FanDuel does not provide tax advice, nor should any statements in this agreement or on the Service be construed as tax advice. By agreeing to these Terms, you are consenting to electronic delivery of all informational tax forms such as .

Welcome to the FanDuel Casino Tax Hub. This FAQ is intended to provide general answers to frequently asked questions related to these Tax Forms for Casino. If you need help with our other products, find them on our main Tax Hub. Tax Center video overview .FanDuel Winngs Tax Rate | Fanduel Tax Percentage | Fanduel and Taxes | Taxes On Fanduel Sportsbook . Gambler Tax Return Preparation . To understand the treatment of gambler taxation, you must know TWELVE BASIC RULES and NINE MYTHS about Gambling. Twelve Rules. 1) Gambling income is not treated fairly in comparison to other types of income.Peb 8, 2024 — Winnings are taxed at the same rates as regular income. What are the Gambling Tax Rates in Ohio? Ohio gambling taxes are on a graduated scale based on your total ordinary income. Gambling winnings from Ohio sports betting apps will count as “Other Income” but are taxed as part of your total. The parameters change over time, but as of tax .Nob 10, 2023 — Discovering the strategies to optimize your tax situation can be the key to truly savouring the fruits of your FanDuel successes. Join us as we explore the tactics and insights on how to avoid paying taxes on FanDuel that may help you avoid unnecessary tax hits and emerge as a savvy winner both on and off the FanDuel platform. Let's dive into the game of tax .

Get answers for your Sportsbook, Casino, Daily Fantasy, TVG, Racing, or Faceoff questionsHun 13, 2023 — In 2022, legal sports wagers on sites like FanDuel and DraftKings totaled $93.2 billion. Wall Street Journal tax reporter Laura Saunders joins host J.R. Whal.

For Form 1099 (tax purposes), FanDuel is required to pair up and “match” entry fees to the date in which the underlying contest settles, not the date when the entry fee was placed. As a result, the total entry fees considered for you Form 1099 may not always match the entry fees as reported on your Player Activity Statement.Fantasy sports winnings of $600 or more are reported to the IRS. If it turns out to be your lucky day and you take home a net profit of $600 or more for the year playing on websites such as DraftKings and FanDuel, the organizers have a legal obligation to send both you and the IRS a Form 1099-MISC.If you receive your winnings through PayPal, the reporting form may be a .

Bet online with America's best sports betting site, FanDuel Sportsbook. Get live odds on sports and sign up with our latest promos!

Bet online with America's best sports betting site, FanDuel Sportsbook. Get live odds on sports and sign up with our latest promos!Peb 24, 2024 — Understanding the criteria FanDuel uses to determine tax withholding amounts is fundamental to planning your financial obligations. Typically, there are two key deciding elements that dictate the quantity of money FanDuel retains for federal taxes: Winnings Threshold. FanDuel withholds taxes on certain types of games based on winnings thresholds.

Nigeria Hookup WhatsApp Group Link. Hookup is a kind of emotional one-day routine between a man and a woman. But as far as dating is concerned they will continue the relationship for a long time. But as far as the hookup culture is concerned, both man and woman share their feelings with strangers one day and night only.

taxes on fanduel|Tax Considerations for Fantasy Sports Fans